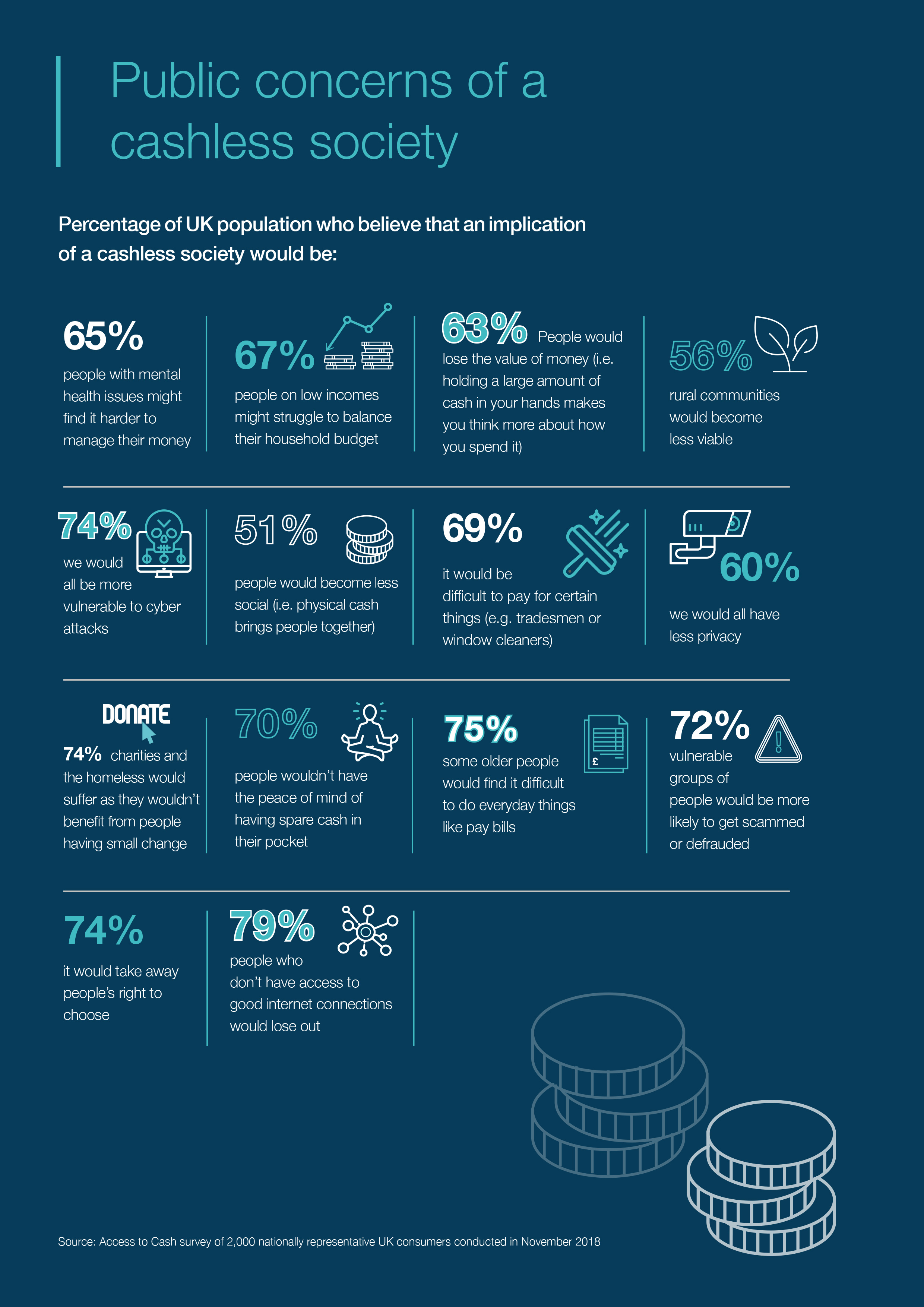

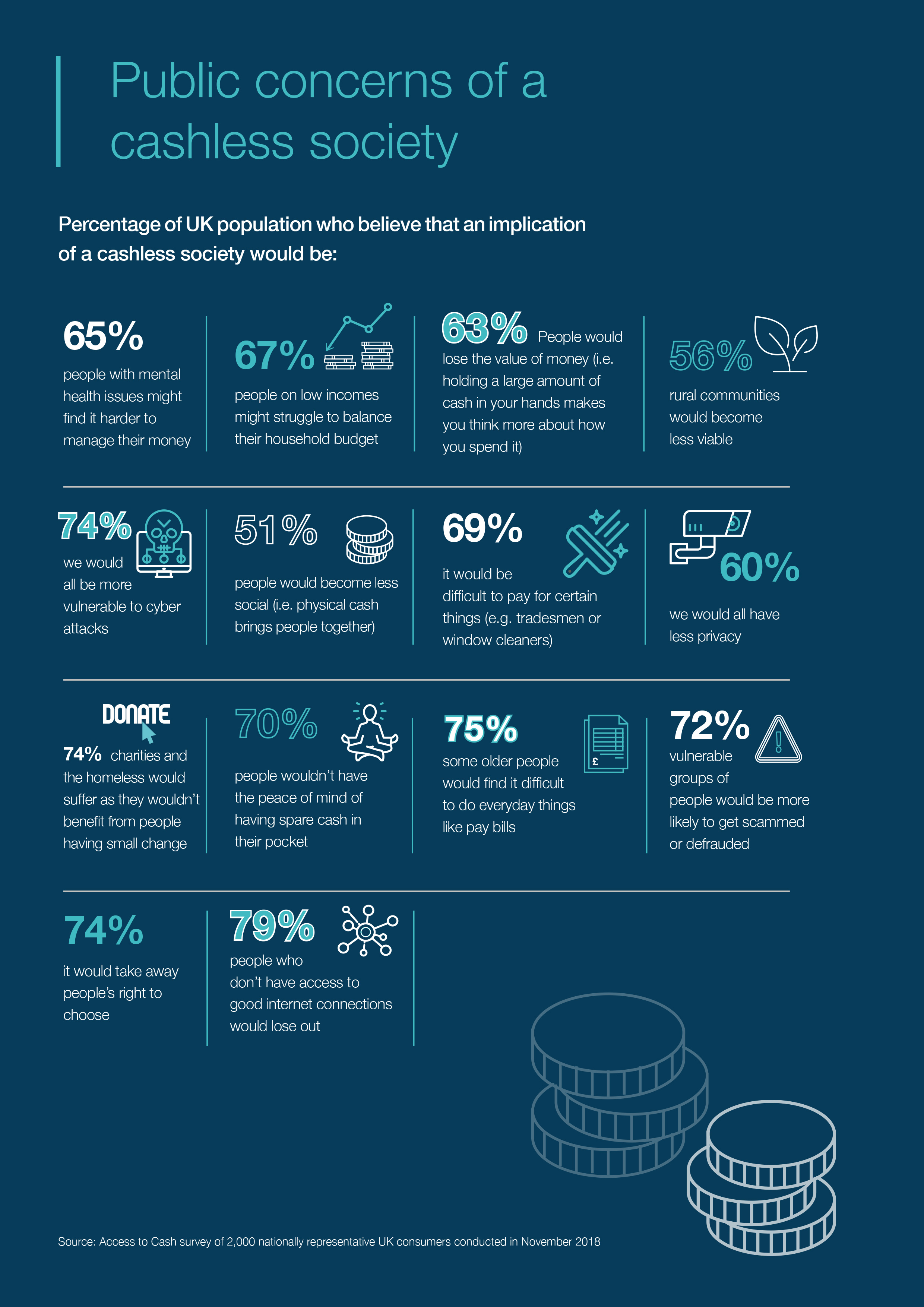

For 25 million people in Britain, or 47% of the population, cash is an economic necessity and living without it would present real challenges.

For more information, visit the Access to Cash Review here.

The average cost of processing a cash transaction is well below the costs associated with handling card payments. According to the British Retail Consortium (BRC), cash remains by far the cheapest payment method for retailers, “accounting for less than 8% of retailers’ overall payment acceptance cost, despite driving 37% of all transactions.” In contrast, processing card transactions costs remains a very high and increasing – accounting for 61% of retail transactions but 83% of retailers’ cost of collection.

Without cash to provide competition for payment volume, the cost of payments for retailers increases, and in the end, the additional cost will be almost certainly passed down to the consumer.

When the use of cash declines, payments fall increasingly into the control of private companies. With two dominant parties and already rising payment processing costs, who is looking out for the merchant and consumer?

The more swiping, tapping and clicking, the less aware people become of their spending behaviour.

The physicality of cash - being able to hold it, count it and when it’s gone, it’s gone - is essential for many households to budget, especially during a recession.

Money tucked in birthday cards, interactions at shops or teaching children important money lessons - there’s an emotional, communal and economic value attached to physical cash.

The elderly, as well as those that struggle with mental health or technology would be at risk of financial abuse; being forced to bank online and hand over control to someone else.

A cashless society is vulnerable to system failures and online fraud, both of which account for innumerable cases of theft and scams.

More mobile, card and contactless payments increases the amount of your data being collected, shared and sold and increases the risk of “surveillance capitalism”. Cash protects your privacy and the anonymity of its users. It is safe.

For more information, visit the Access to Cash Review here.